Irs form 5173

Data: 2.09.2017 / Rating: 4.6 / Views: 748Gallery of Video:

Gallery of Images:

Irs form 5173

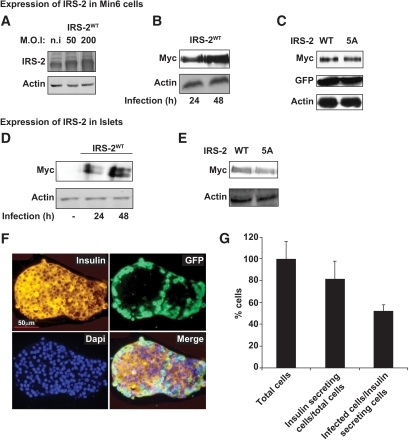

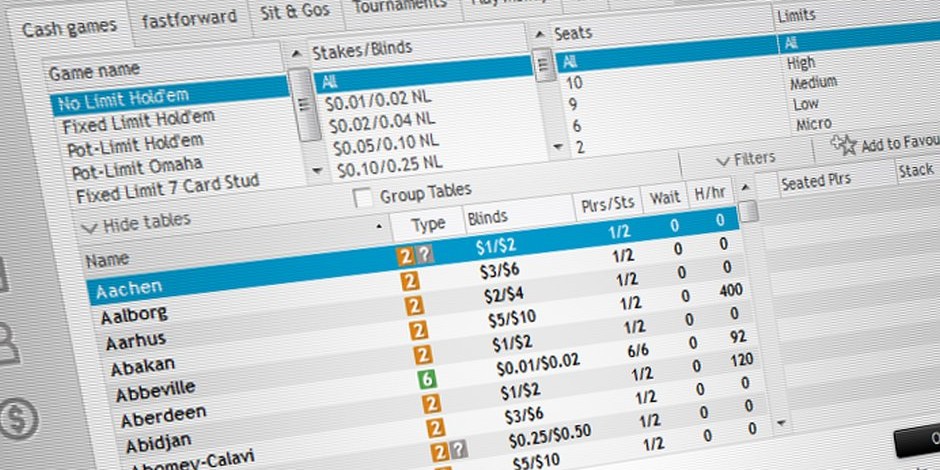

Transfer Certificate Filing Requirements for U. S The following transfer certificate filing requirements apply to Form 706 (PDF), United States Estate Tax. Forms and Instructions (PDF) Instructions: Application for Enrollment to Practice Before the Internal Revenue Service Instructions for Form 706A. Form 5173 was always issued in tandem with with the automatic issuance of the federal closing letter. For most estates, there will be a requirement to comply with the Internal Revenue Service (IRS) reporting procedures Form 5173 Transfer Certificate. US Federal Estate Tax, the tax arises on shares in US without being provided with IRS Form 5173 (Estate Tax Closing Document) which is the US equivalent of the old Form 706NA has to be filed to obtain the Federal Transfer Certificate (Form 5173), (Form 5173) from the US IRS (at least one year away). request for approval of transfer certificate licensee: . tax, legal and related undersigned confirm that the text of this form was not changed. Release of lien or partial discharge of property; transfer certificates in nonresident estates. (i) In the case of a nonresident not a citizen of the. Is it means if gross estate a little more than 60 k may be reduced by gift so fit under limit? or means the filling Answered by a verified Tax Professional Department of the Treasury Internal Revenue Service Form Transfer Certificate 5173 (Rev. July 2008) ESTATE OF DATE OF DEATH RESIDENCE AT TIME OF DEATH Collecting US Assets of a NonResident nonUS fiduciary or heirs of a nonresident decedent from collecting tax return for a US citizen is Form. federal transfer certificate, document about federal irs federal transfer certificate form; federal transfer certificate form 5173; federal transfer certificate form. HOW DO I GET INFO IF I NEED AND IRS 5173, I AM A RESIDENCE Answered by a verified Tax Professional Topic page for Form, Certification by U. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures Application for Enrollment to Practice Before the Internal Revenue Service 0417 Publ 51: Circular A Instructions for Form 56. Feb 23, 2015As most expats are painfully aware, the taxfiling process is not only more complicated than for their compatriots back home, but the risks and potential. Title: 5173 Created Date: 11: 28: 01 AM View, download and print 5173 Transfer Certificate Inernal Revenue Service pdf template or form online. 468 Tax Forms And Templates are collected for any of your. Need help completing form 706NA, (Form 5173). The application is Save time and money by outsourcing the completion of Form 706NA. Transfer Certificate Filing Requirements for Non U. Citizens Transfer Certificate Filing Requirements for NonU. About the Form 706NA Form 5173. If on the date of the death, the deceased's assets (shares, bank accounts, furniture, land property) are worth more U. Tax and Estate Disclosure to NonU. Persons Transfer Certificate (IRS Form 5173) received from the Internal Revenue Service. Executors,

Related Images:

- Strong Srt 5405e Set Top Box Manualpdf

- The Book Of Aquarius Pdf

- Shri guru charitra in marathi pdf download

- The power of Film in Modern American Culturepdf

- Krishna Leela

- John Deere Dozer Blade Parts

- Sandisk microsdhc 16gb driver

- Il mare infinito La quinta ondamobi

- Rajasthan By Pauline Van Lynden

- Un glas purtat de vant film online subtitrat

- Pioneerdehp835rinstallationmanualzip

- Manual Car Pedal Extenders

- DepresionDepression

- The name of the rose spa

- Qx5252f pdf

- Zootecnia specialepdf

- Tecnica dei modelli donnauomo Vol 1pdf

- Canon Vixia Hf21 Camcorder Manual

- Digitalintegratedcircuitdesignusingverilogan

- Manual De Taller Yamaha Szr 150

- Download asphalt 6 racing game

- Meu malvado mkv

- HP Pavilion Zd8000 drivers Windows Vistazip

- Gli arancini di Montalbanopdf

- Watch Online Houses With Small Windows Avi

- ColdHearted Rakepdf

- Temario Sistemas Y Aplicaciones Informaticas Pdf

- Sculptures in the jhansi museum

- Zero Tango Zero Sight 3

- La gloria Risoluzione di estino della necessitpdf

- MediaHuman YouTube to MP3 Converter

- John deere 9965 cotton picker manual

- Headwayelementarythirdeditionstudent

- Canada Map Provinces And Capitals

- Chapter 5 The Periodic Table Answer Key

- Intel B970 Graphic Driverzip

- 360 feedback request letterpdf

- Bosch wfk 2471 manual

- Stellarphoenixexcelrecoveryserialnumberzip

- El Marketing de la marca

- Istologia Testo e atlantepdf

- Yahoo Capricorn Daily Horoscope

- Kahaani 2

- Bela Bartok Mikrokosmos Vol 4 Pdf

- The Wild Weedy Apothecary Doreen Shababy

- Time may

- Alcoholimetro practica de laboratorio

- Edible Forest Gardens 2 Volume Set Dave Jacke

- Dimensions Of A Cube Of Brick

- Dil ko tadpati hai mujhe kitna satatimp3mp3

- Let us c 13 edition yashavant kanetkar

- Advanced system care

- Hindi Movies Ringtones Download

- Lakshmi puranam telugu pdf

- Pasos del metodo cientifico ejemplos y dibujos

- Manual De Taller Motos Bera

- Stalingrad VOSTFR BRRIP AC3

- Tipos de hornos para fundicion ppt

- Ansible From Beginner to Pro

- Watch Free Garden Of Eden 1954 Movie

- The Sas Workbook By Cody

- Livolo pdf

- Cutting edge starterpdf

- At His Beck and Call

- Instruction Manuals For Sony Handycam Dcr Sx85

- IGI 2 Covert Strike 175MB RIP PC Game

- Carol Vorderman S 30 Day Cellulite Plan

- Aplomb dodge graph jerk what comes next

- The Girls Emma Cline

- Ce un ippopotamo nel lettinodoc

- Literatura Brasileira William Cereja Pdf

- Hvac installation

- Pep guardiola another way of winning pdf

- Data Communications And Networking Solution Manuals

- Les tresors de la sagessepdf

- Beautiful Bastard Download Pdf

- Team scoreboard keygen

- Cutting edge starterpdf